How much are you Really paying in Taxes?

So, you got money back on your taxes and you're celebrating! Woohoo! But do you realize you are getting your own money back that you overpaid during the year? (See Tax Season Roulette)

So, how can I know how much taxes I paid for the whole year including on my return? You know.....so I know whether to pull out my party hat or my mourning gown? The easiest way is to grab one of your tax returns. You should have a 1040 Individual Tax return with a whole bunch of pages. We only need the first two pages.

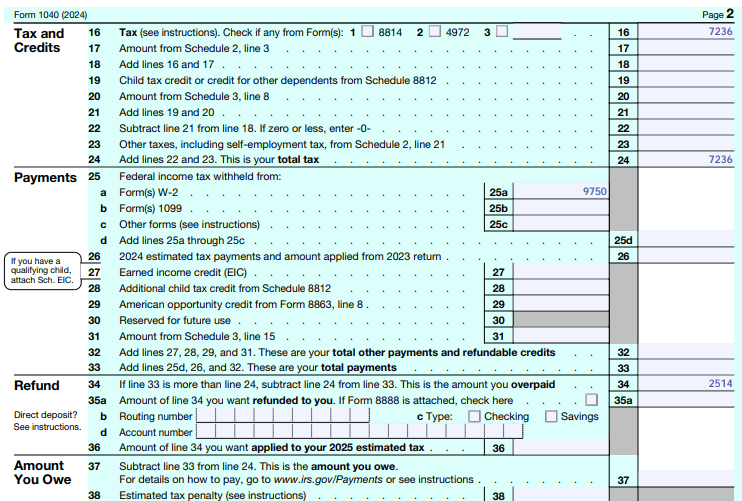

On page 2, find your "total tax". It should be in bold black print. In our example it is $7,236. On page 1, find "total income". It should be in bold black print. In our example it is $70,000. Then divide the total tax by the total income. In our example it would look like 7,236/70,000 = 0.1033714. When we multiply the solution by 100 we get a percentage: 10.3%. So we paid $7236 in taxes and we were taxed at a 10% rate.

Is that good?

That all depends on you and your goals. It is better than paying 15% and not as good as owing no taxes.

In our example the government collected over $2,000 dollars and earned interest on it and gave it back to you at the end of the year. You could have either invested that money or collected the interest from a high interest account yourself if you didn't have it taken out of your check. You also could have paid them nothing during the year, put all $9,000 that was taken from your check into a high interest account and then paid your taxes at the end of the year making even more interest.